Business Society News, August 30th

1, Price Trends

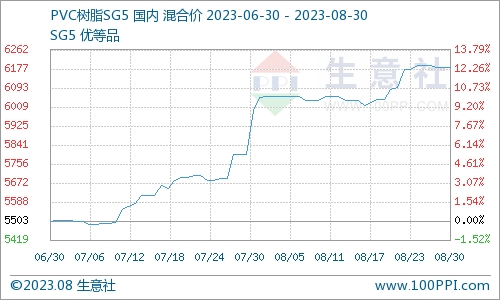

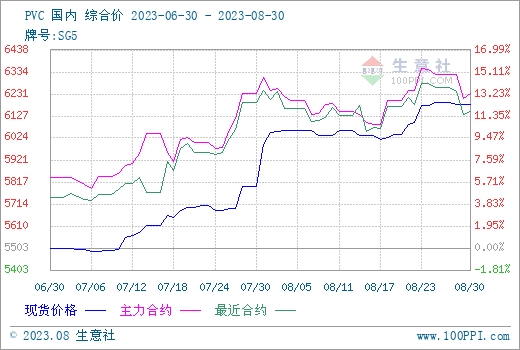

According to data monitored by the Business Society, the spot market price of PVC (6309, 75.00, 1.20%) increased in August. The average domestic PVC price was 6,052 yuan/ton on August 1st, and it increased to an average of 6,184 CNY/ton on August 30th, marking a 2.18% increase for the month.

2, Market Analysis

The spot market price of PVC increased in August. During the early and middle parts of the month, PVC spot prices experienced slight fluctuations. The trading atmosphere in the spot market was unfavorable, and trading activity remained subdued. Traders showed limited enthusiasm for purchasing, while downstream buyers procured based on demand, exercising caution. In the latter part of the month, the futures market frequently experienced price increases, leading to a positive shift in the spot market sentiment. Low-priced supply sources were scarce, causing prices to continue rising. However, downstream market demand was moderate, and resistance to high prices was evident, leading to somewhat inadequate follow-through on actual orders. Currently, confidence in the PVC spot market remains reasonable, with prices stabilizing towards the end of the month. As of now, domestic PVC Type 5 calcium carbide prices are mostly in the range of 6,150 to 6,350 CNY/ton.

In August, crude oil exhibited a pattern of rebounding from highs. In the early part of the month, the market continued to rise due to ongoing concerns about supply and positive trends in petroleum consumption during the peak season. Brent crude oil surpassed $87 per barrel, and WTI crude oil approached $83, reaching a nearly 9-month high. Subsequently, as macroeconomic data worsened, the market reversed sharply, and by the end of the month, WTI fell below $80. With the combined effects of OPEC+ production control and weak economic data in oil-producing countries, the tug-of-war between supply and demand intensified, causing the market to enter a phase of narrow-range oscillation. In the short term, the momentum for oil market continuation is limited. With weak demand expectations and offsetting supply tightness, it is highly probable that the market will primarily experience narrow-range oscillations.

In terms of calcium carbide, according to the Business Society's commodity analysis system, the ex-factory prices of calcium carbide in the northwest region saw a significant increase in August. The price rose from 2,950.00 CNY/ton at the beginning of the month to 3,283.33 CNY/ton at the end of the month, marking an 11.30% increase. The end-of-month price decreased by 11.26% compared to the previous year. Looking ahead, in the first half of September, the calcium carbide market may see a slight increase and mainly consolidate. The upstream raw material price of blue carbon remains at a high level, providing substantial support to calcium carbide costs. The downstream PVC market has experienced a slight increase, indicating good demand. It is projected that in the first half of September, calcium carbide prices in the northwest region may experience slight fluctuation and consolidation.

3, Future Forecast

PVC analysts at the Business Society believe that the ex-factory price of calcium carbide significantly increased in August, with strong cost support. Recently, PVC futures prices have risen frequently. However, the market's acceptance of high-priced supply sources is relatively low. Trading conditions are average, and downstream buyers procure cautiously based on demand. It is expected that the PVC market will continue to experience oscillations within a range in the short term, with close attention to changes in the news landscape.

(Article Source: Business Society)